Tax Navigation by PaperWerks

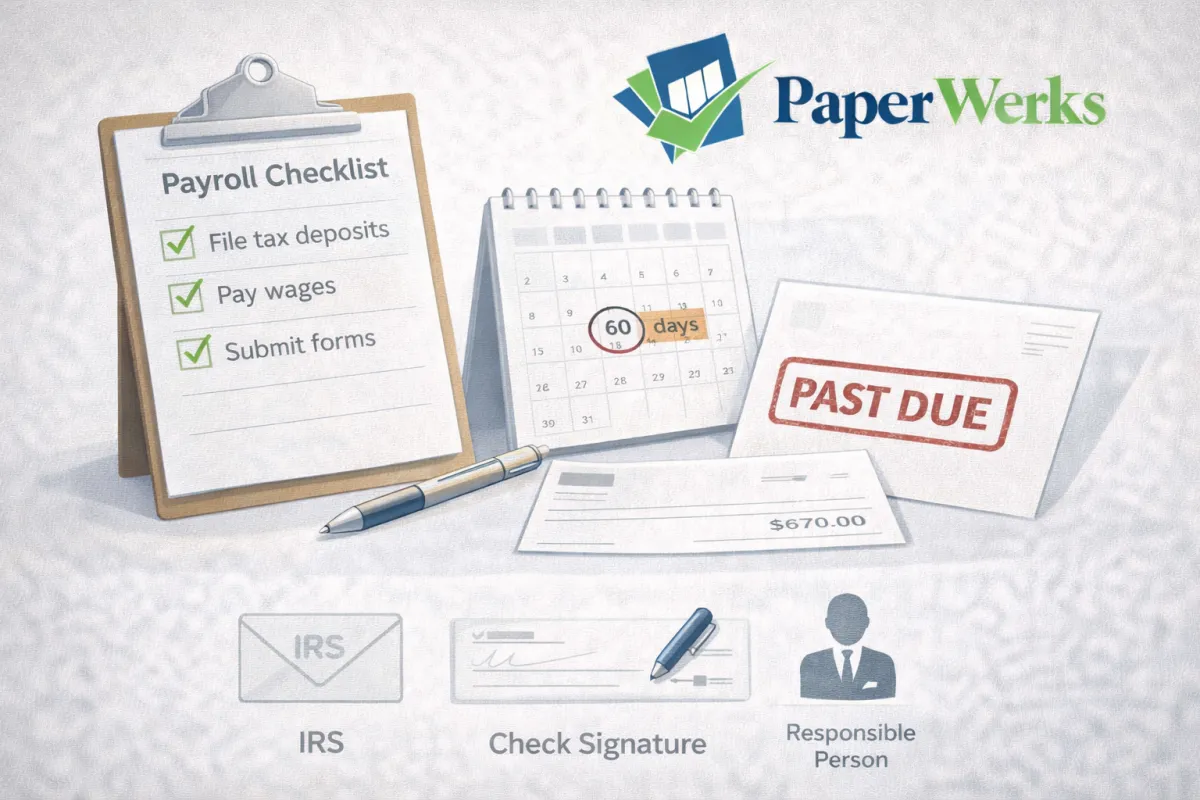

Trust Fund Recovery Penalty (TFRP): Who Can Be Held Personally Liable for Unpaid Payroll Taxes

Published on: 02/01/2026

A practical overview of the IRS Trust Fund Recovery Penalty (TFRP), including who may be deemed a “responsible person,” how the IRS defines willfulness, what Form 4180 interviews involve, and why responding to Letter 1153 within 60 days is critical.

IRS FormsPayrollAppealsPenalty